Fun Facts: Industry Data as of Jan 2021

Data Courtesy: Professor Damodaran's website

References: Prof's Blog

Here are a few insights from industry data.

1. Economic Value Added: Economic Value Added(EVA) is the excess of return on capital over the cost of capital or the excess of return on equity over cost of equity.

The following chart displays the best performing industries in the USA as of Jan 2021 based on past 12 months data.

As you can see Software, Computer Hardware, Financial Services, Healthcare, Pharma, Banks, Consumer Goods, General Retail are among the best performing industries.

Let us look at the laggards in terms of EVA in the chart below. Remember Return on Equity can be very high but what is the point if the Cost of Equity is even higher.

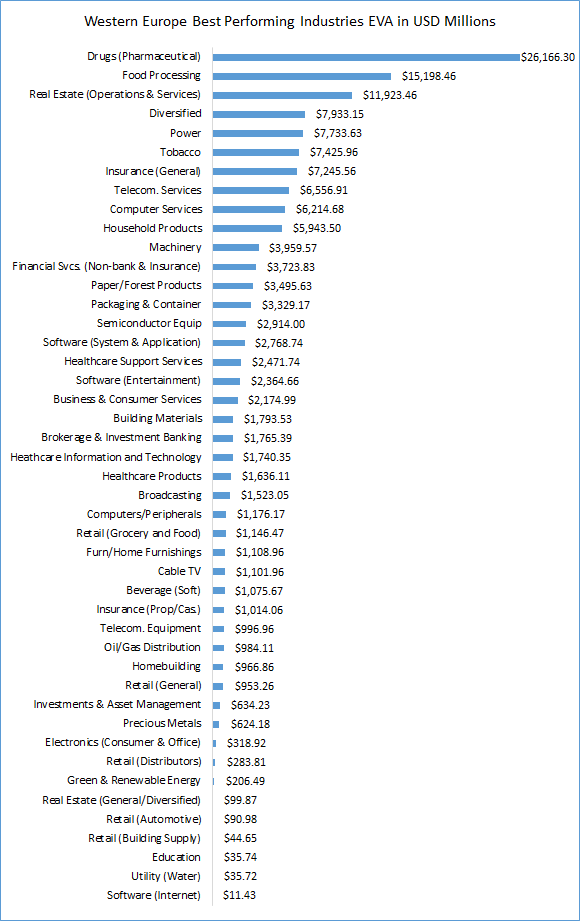

Oil and Gas, Air Transport, Hotels, Entertainment, Biotech, Speciality Retail are among the worst performing industries.Let us go to Europe and look at the best and worst performers. The following chart shows the list of best industries in terms of Economic Value Added as of Jan 2021.

Pharma, Food Processing, Real Estate, Power, Tobacco, General Insurance are among the top performing industries in the Western Europe. Financial Services, Software are also among some of the better performing industries in the Western Europe.

The chart below shows some of the worst performing industries in the Western Europe in terms of EVA for the trailing 12 months as of Jan 2021.

Like in the United States commodity based industries Oil and Gas, Air Transport, Hotels and Gaming, REIT, Bio tech drugs are among the worst performing industries. Money Center Banks which are performing well in the US are not doing well in the Western Europe.

From Europe let us fly to the land of rising sun - Nippon and take a look at the best and worst performing industries in terms of EVA for the trailing 12 months as of Jan 2021.

Financial Services, Telecom Wireless, Pharma, Computer Services are among the best performing industries.

Let us look at the worst performing industries in Japan in terms of EVA for the trailing 12 months as of Jan 2021.

Auto and Truck, Money Center Banks, Steel, Auto Parts, Transportation, Banks Regional are among the worst loss making industries in Japan.

From Japan let us go to the world's leading economy in GDP (PPP) terms China and examine different industries in terms of EVA for the trailing 12 months as of Jan 2021.

China's state sponsored Banks, Real Estate Development, Insurance, Food Processing, Construction, Software, Regional Rural Banks are among the best performing industries.

Air Transport, Oil/Gas, Real Estate (Operations and Services), Hotels and Gaming, REIT are among the worst loss making industries.

From China let us go to India and take a look at the worst and best performing industries in terms of EVA for the trailing 12 months as of Jan 2021.

Computer Services, Financial Services, Household Products, Food Processing and Tobacco are among the best performing industries in India.

Money Center Banks, Telecom Wireless, Auto and Truck, Steel, Oil and Gas, Metals and Mining are among the worst performing industries in India.

For emerging markets as a group given below is the list of best performing industries in terms of EVA for the trailing 12 months as of Jan 2021.

Bank(Money Center), Real Estate Development, Food Processing, Insurance and Software (Entertainment) are among the best performing industries in the emerging markets.

Air Transport, Oil/Gas, Hotels and Gaming, Oil Field Services, Auto and truck and Steel are among the worst performing industries in this region.

And finally to conclude let us look at the performance for the globe as a whole in terms of EVA for the trailing 12 months as of Jan 2021.

Financial Services, Banks, Computer Peripherals, Software, Food Processing, Pharma are the best performing industries in the world.

Oil and Gas, Air Transport, Auto and Truck, REIT, Hotels and Gaming are the worst performing industries in the world.2. Cost of Equity: The Cost of Equity is the expected rate of return on the equity of the respective company. A higher cost of equity indicates a perception of greater risk in the eyes of the investor.

Cost of Equity is calculated as Risk free rate + Beta * Equity Risk Premium

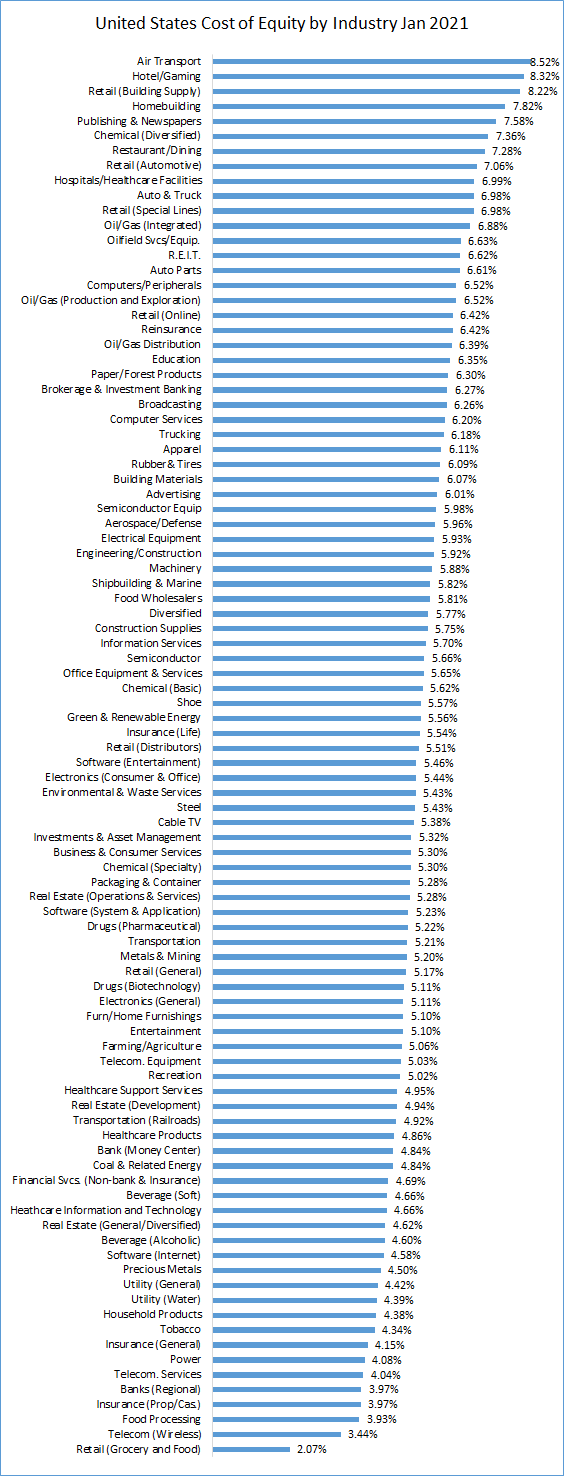

In the chart below costs of equity for different industries of the US market are listed.

The average cost of equity for the US market as a whole is 5.55%. Air Transport, Hotel/Gaming, Retail, Home-building, Publishing & Newspapers are among the riskiest industries while Retail (Grocery and Food), Telecom(Wireless), Food Processing, Insurance and Regional Banks are the industries demanding least return on equity.

From US let us go to Western Europe and examine the Cost of Equity for each of these industries.

The average cost of equity for Western Europe as a whole is 6.27% which is higher than the average US cost of equity by 0.72%. Air Transport, Reinsurance, Auto Parts, Auto & Truck, Oil/Gas are the riskiest industries in Western Europe. Utility(Water), Tobacco, Regional Banks, Retail Grocery and Food, Alcoholic Beverages are the perceived to be least risky by investors.

From Western Europe let us go to Japan and examine the cost of equity by industry.

In Japan, Oil and Gas, Semiconductor and Equipment, Aerospace, Auto & Truck, Software Internet are the riskiest industries whereas Beverages, Transportation, Food Processing, Power and Tobacco are the cheapest. The average cost of equity across all industries in Japan is 7.19%.

From Japan to China, let us look at the cost of equity for all the industries of China.

In China, Retail Automotive, Tobacco, Retail Online, Auto & Truck, Software(Entertainment) and Air Transport are the costliest industries in terms Cost of Equity whereas Home Building, Food Wholesalers, Regional Bank, Investments and Asset Management, Business and Consumer Services are the cheapest. For the Chinese market as a whole, the cost of equity is 6.01% that is cheaper than Europe and slightly costlier than US.

Coming to India, given below is the chart showing the Cost of Equity across industries.

In India, Semiconductor Equip, Reinsurance, Home Building, General Insurance and Regional and Money Center Banks are among the industries having highest expected rate of return. Industries with lowest cost of equity include Food Wholesalers, Software, Broking and Investment Banking, Healthcare Products, Retail Food and Grocery and Soft Beverages. The average cost of equity for India across all industries is 7.53%.

For the group of emerging markets the chart below shows the list of industries by cost of equity.

For emerging markets Semiconductor Equip, Oil/Gas, Home-building, Air transport, Online retail, Healthcare IT are trading high on cost of equity whereas Tobacco, Soft Beverages, Grocery and Food, General Insurance and Food Wholesalers are the cheapest. The average cost of equity across industries in emerging markets is 7.84%.Concluding on cost of equity, let us summarize by looking at the cost of equity of the global markets as a whole.

For Global Markets as a whole, Semiconductor and Equip, Air Transport, Auto & Truck, Auto Parts and Diversified Chemicals are among industries with highest cost of capital whereas Retail Grocery and Food, Tobacco, Regional Banks, Soft Beverages, General Insurance are those industries with lowest required rate of return. For the market as a whole the average cost of equity is 6.76%.3. Cost of Debt: The cost of debt shown here is calculated based on the standard deviation of the stock and the risk free rate of the respective country.

These are only estimated values of cost of debt and the actual cost of debt can vary around this figure basing on the creditworthiness of the issuer.

For the US market the yield on 10-year treasury bond is considered as risk free rate. Remember this is the cost of debt for 12 months ending in Jan 2021. The US 10-year bond yield has risen by at least 75 basis points since Jan 2021 and can raise further by the end of the year. So debt issuers may have to face higher costs while raising new debt or refinancing existing debt.

The cost of debt for US industries ranged from 1.92% to 4.09%. The average cost of debt for the market as a whole is 3.00%.

In Western Europe, estimated cost of debt ranged from 1.88% to 2.95%. The cost of debt was first calculated in dollar terms and then converted into Euros using inflation numbers. Again this is subject to increase due to increase in risk free rate that is the 10-year US bond.

From Western Europe let us move to Japan and the chart below shows estimated cost of debt for different industries.

For the Japanese market as a whole the average cost of debt is around 1.63%.

The cost of debt across industries of China is shown in the chart below.

The average cost of debt across markets is around 5.24%.Let us take a look at cost of debt for India across various industries in the chart below.

The cost of debt for the market as a whole is around 7.63%. Note that cost of debt for Indian Corp orates is much higher than those in other markets. Even in dollar denominated debt the average cost of debt is 4.53% which is 150 basis points higher than the US market.

The chart below shows the cost of debt across industries for the group of emerging markets.

The chart below shows the cost of debt for the global markets as a whole in dollar denomination.

For the global markets as a whole the average cost of debt is around 3.53%. This once again proves that debt is cheaper than equity (6.76%).4. Debt to Total Capital: Let us examine the proportion of debt for each industry across different countries and regions specified above. Debt is a double edged sword and when the tide turns around you get know who's swimming naked!

Debt for the purpose of this ratio includes lease debt and total capital is debt + market cap of equity.

The chart below shows the Debt to Total Capital for the US market for 12 months ending with Jan 2021.

Financial Services, Air Transport, Oil and Gas, Money Center Banks are among the top heavily indebted industries whereas Software, Online Retail, IT services, Electronics are least indebted.

For US as a whole the proportion of leverage out of total capital is 32.58%.

The chart below presents the proportion of debt out of total capital for Western European Industries.

The proportion of debt out of total capital for Financial Services (Non-Banks and Insurance) in the United States is very high close to 90% whereas for Western European Financial Services it is only 84.79%. Given the systemic inter-connectedness, a higher proportion of equity may be warranted for Financial Services(Non-Bank and Insurance) in the US.

For Western European countries as a group Money Center Banks, Financial Services, Food Wholesalers, Regional Banks,Trucking and Transportation industries are heavily indebted. Software, Healthcare IT, Semiconductor Equipment, Electronics and Home Building industries have very low proportion of debt on their balance sheet.

For the Western European market as a whole the proportion of debt across industries is 46.95%.

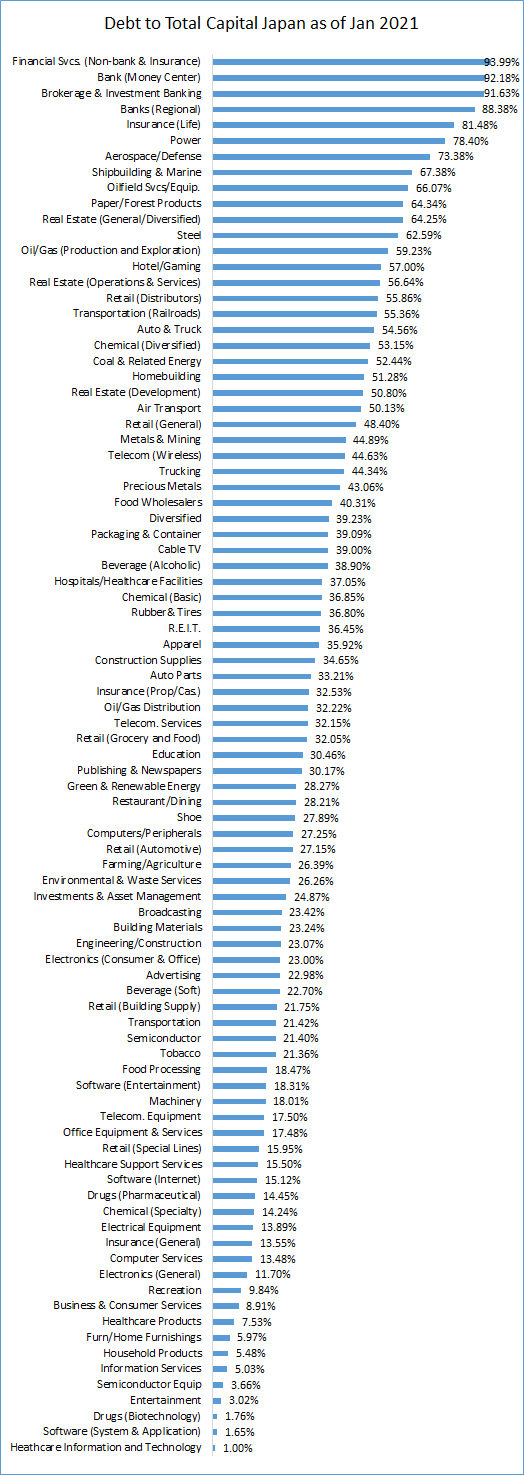

For Japanese industries the chart below shows the proportion of debt on their balance sheet.

In the Japanese market Financial Services, Money Center Banks, Brokerage & Investment, Regional Banks, Life Insurance, Power are among the highly leveraged industries. Software, IT Services, Healthcare and Healthcare IT, Consumer Services are among the least indebted industries.

The chart below presents the proportion of debt out of total capital as of Jan 2021 for Chinese industries.

In China, Investment and Asset Management, Regional Banks, Money Center Banks, Real Estate Development, Engineering Constructions, Reinsurance and Retail Distributors are among the most indebted industries. Tobacco, Beverage(Alcoholic), Soft Beverage, Healthcare IT, Drugs Biotech, Healthcare Products, Online Retail are among the least indebted industries.

For the Chinese market as a whole the proportion of debt is 36.61% out of total capital.

From China to India, let us take a look at the proportion of debt for Indian industries.

Indian Industry's debt dependence is far lesser than their global counterparts. Precious Metals, Oil/Gas, Financial Services, Home-building, Retail Automotive and Special Lines, Power are the most debt dependent industries while Retail Grocery and Food, Tobacco, Household Products, Software, Insurance, Healthcare Support Services are least debt dependent.

For the market as a whole the debt to capital ratio is 29.72%.

For emerging markets as a group the following chart shows the proportion of debt out of total capital for various industries.

In the emerging markets group Investments and Asset Management, Regional Banks, Real Estate Development, Money Center Banks, Engineering/Construction, Investment Banking are the industries which are highly indebted while Healthcare IT, Tobacco, Drugs Biotech, Alcoholic Beverages, Software, Online Retail are the least debt dependent industries.

The total debt to capital ratio across all industries for emerging markets is 35.69%.

For Global Markets the chart below shows the proportion of debt out of total capital.

Non bank & Insurance, Money Centre Banks, Investment Banking, Regional Banks, Real Estate Development, Air Transport are among the industries that are highly dependent on debt whereas Software, Online Retail, Semiconductor Equip, Healthcare and IT, IT services, Drugs Biotech are among the industries which are least dependent on debt.

For Global Markets as a whole the debt to capital ratio is 61.32% across all industries.

5. Net Cash Returned/FCFE: Buybacks are global phenomenon now, so dividend payout and dividend yield may not make much sense any more. So Net Cash Returned/FCFE has been used below.

Net Cash Returned = Dividends + Buybacks - New Equity Issues

FCFE = Net Income + Depreciation & Amortization - Capex + New Debt Issues - Old Debt repayments

(All the cash figures in the chart below are in millions of dollars)

Unfortunately, this data is not available for the United States, so I borrowed a snapshot from Prof's blog.

The table above shows the buybacks as a percent of cash return which is the sum of dividends and buybacks for trailing twelve months as of Jan 2019. We can see that Software, Money Center Banks, Computer/Peripherals, Semi Conductor were among the industries that bought back the most in 2018. Green Renewable, Shipbuilding, Electronics, Metals and Mining are among the industries that bought the least.From US let us move to Western Europe and examine the Net Cash Returned/FCFE ratio for various industries.

Industries that are showing very high net cash returned to FCFE are those which actually borrowed debt to return cash to investors. Other industries which have a negative FCFE have been omitted from this chart. There are other industries which have not returned cash on a net cash flow basis but they actually borrowed from the markets and such industries have also been omitted from this chart.

As you can see in the chart Regional Banks, Telecom Equipment, Office Equipment & Services, Information Services, Auto & Truck, Real Estate Development are among those industries that returned least cash to investors in Western Europe for the trailing 12 months as of Jan 2021. Diversified Chemicals, Oil/Gas Integrated, Telecom, Aerospace Defense, Food Processing and Chemicals are among the industries that returned highest cash to investors in Western Europe in percentage terms for the trailing 12 months as of Jan 2021. To get a better perspective the absolute amounts of cash returned or raised is shown in the chart below.

Some companies are strange - they have negative net income yet they pay dividends and buyback stocks from equity or debt issuance.

The chart below shows the net cash returned as a percentage of FCFE for Japanese Industries.

We can see that Diversified, Published and Newspapers, Transportation, Telecom(Wireless), Retail are among those that have returned cash whereas Telecom Services, Hospitals/Healthcare Services, Real Estate, Insurance, Green & Renewable Energy are among those industries that raised capital from the capital markets.

Those industries with negative FCFE after debt cash flows have not been included in this chart.

The proportion of actual cash returned by industry for Japanese industries has been shown in the chart below.

In terms of absolute cash we can observe that Telecom(Wireless), Retail (Distributors), Money Center Banks, Drugs(Pharma), Computers/Peripherals are among the industries that returned highest cash to investors whereas REIT, Real Estate(Operations and Services), Telecom Services, Hotel and Gaming, Computer Services, Beverage and Drugs are among those industries that raised cash from capital markets.

The chart below shows the net cash returned as a percentage of FCFE for Chinese Industries.

Some of these numbers are disproportionately large, so let us take a look at the absolute cash figures to get a better picture.

As you can see Retail Online, Money Center Banks, Drugs(Biotechnology), Healthcare, Software, Semiconductor are among those industries which raised cash from the capital markets while Real Estate, Insurance, Power, Coal and Related Energy, Construction Supplies, Oil/Gas Integrated are among those industries that returned highest cash to investors.From China let us move to India and take a look at Net Cash Returned/FCFE for different industries.

The chart below shows the total dividends paid by different industries in India.

Computer Services, Power, Financial Services, Tobacco are among the industries that have paid highest dividends in the twelve months ending in Jan 2021.

Let us take a look at the emerging markets as a group.

Oil/Gas, Real Estate, Power, Insurance and Steel are among those industries that returned highest cash in the group of emerging markets whereas Retail, Drugs(Biotechnology), Healthcare and IT, Air Transport and REIT are among those that borrowed cash from the capital markets in the group of emerging markets.

And finally for the globe as a whole let us take a look at the Net Cash Returned/FCFE ratio.

Let us take a look at the actual cash returned by industry across all markets.

As you can observe Drugs(Biotech), Software, Air Transport, Retail and Healthcare IT are among the industries that have raised cash from the capital markets whereas Oil/Gas, Computer Peripherals, Bank Money Center, Drugs, Software are among the industries that returned highest cash to investors.

Watch-out for more interesting articles on finance and economics!

Comments

Post a Comment