Is Airlines Industry a case for natural monopoly?

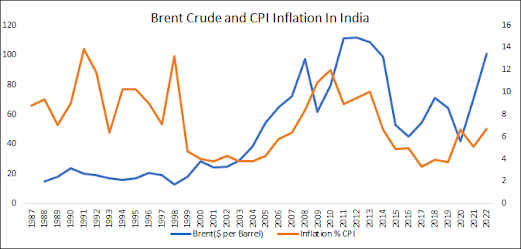

The combined net losses for the global air transport industry for the trailing twelve months( Jan 2023 data) is a whopping $16,238.52 millions. The free cash flow to equity after debt cash flows is even worse at a negative $43,079.23 millions for a total of 155 firms across the globe. Probably there is no other industry that has destroyed so much value! Please take a look at the charts below. Data Sourced from Prof. Damodaran website/S & P Capital IQ This is not the first year that it has happened. For more than couple of decades airlines industry has been making losses across geographies. The fate of the industry is closely tied to fuel prices, whenever the prices rise, the distress in the industry deepens. One is forced to wonder if the airlines industry is a case for natural monopoly like utilities. This is one of those rare cases where competition has worsened the situation for all the stake holders. Co-operation and Consolidation It's high time for co-operation and conso