Resource Allocation and Utilisation: Corporate Profitability meets Economic Objectives

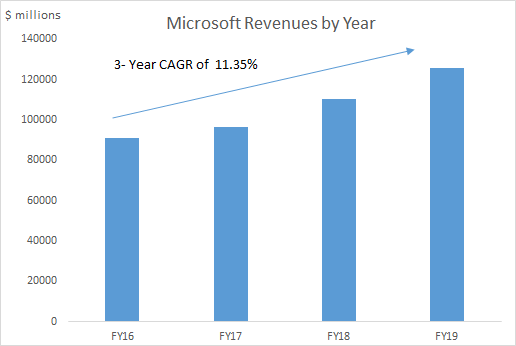

One of the key issues that the field of economics addresses is the optimum allocation and utilization of resources. How do we choose between competing objectives when our resources are limited ? How do we transform scarce resources in to productive outputs and at what cost? In spite of all the advancements of mankind in most fields, these fundamental questions of economics still persist. In a free market economy, the burden of the choice between competing projects/undertakings falls on individuals and businesses. At least once in a while, it is necessary to assess if our collective decision making is navigating us in the right direction. So how do we know if our micro economic decision making enhances broader welfare ? One of the key indicators of efficiency in resource allocation and utilization is corporate profitability. In this context, take a look at these graphs on the basis of data provided by Prof. Damodaran . (Reference and Acknowledgements: Prof. Damodaran's blog post ) O...